Investment Property

Investment Property  Refinancing

Refinancing  Strategies to Create an

Strategies to Create an  Investment

Investment  Business

Business

Maurice Di Dio founded Money Elements, having been a property investor since 2000. Maurice has over 30 years of business experience, being self employed since 1991. We work with our clients to ensure they can get a head in life, through investment in property as a strategy for wealth creation.

We use our experience and our specialised Di-Dio Property Investment model developed over 20 years to identify the best properties to invest in and create a roadmap for every client.

Over 20 years of

Property Investment,

Strategies & Roadmaps

Licensed

Mortgage Broker

Practice what we

preach

Expert in Structuring Investment Property Portfolios

Go out of my way to find solutions

Business Financing

Strategies

I got 50% of my outlay to open my restaurant and had to put up no assets!

We don’t know how to thank Money Elements enough, there is only so much pizza or pasta I can give you. We truly appreciate what you were able to do for us, and we loved your style of thinking.

I was able to follow through with more than one project thanks to Money Elements!

Money Elements, thank you so much for giving us more opportunity than I was ever offed by any bank. The way you guys think and find solutions is just amazing….you guys rock!

We will support you to overcome the challenges you are facing in getting ahead in life, by developing strategies to build and protect your wealth with a clear investment property roadmap and the funding to achieve it.

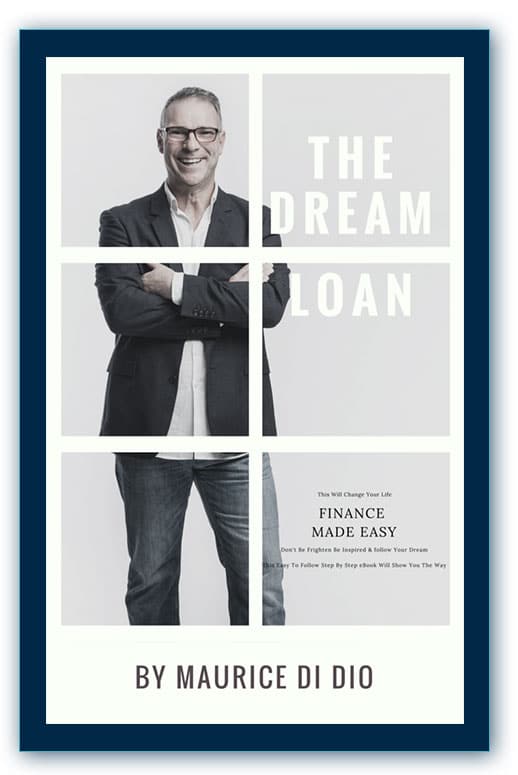

Learn from years of proven strategies and facts of the financial lending world in a few easy to read pages.

1-300-CASH4U (227-448)

1-300-CASH4U (227-448) hello@moneyelements.com.au

hello@moneyelements.com.au Suite 210, 166 Burwood Road, Hawthorn VIC 3122 Australia

Suite 210, 166 Burwood Road, Hawthorn VIC 3122 Australia

Enter your details below to unlock a free copy of The Money Elements Report